Welcome to Money Philosophy, where we’re unpacking the personal, emotional, and cultural forces that shape how Gen Z women think about money. We’re asking real women to reflect on the why behind their financial decisions—not just the what.

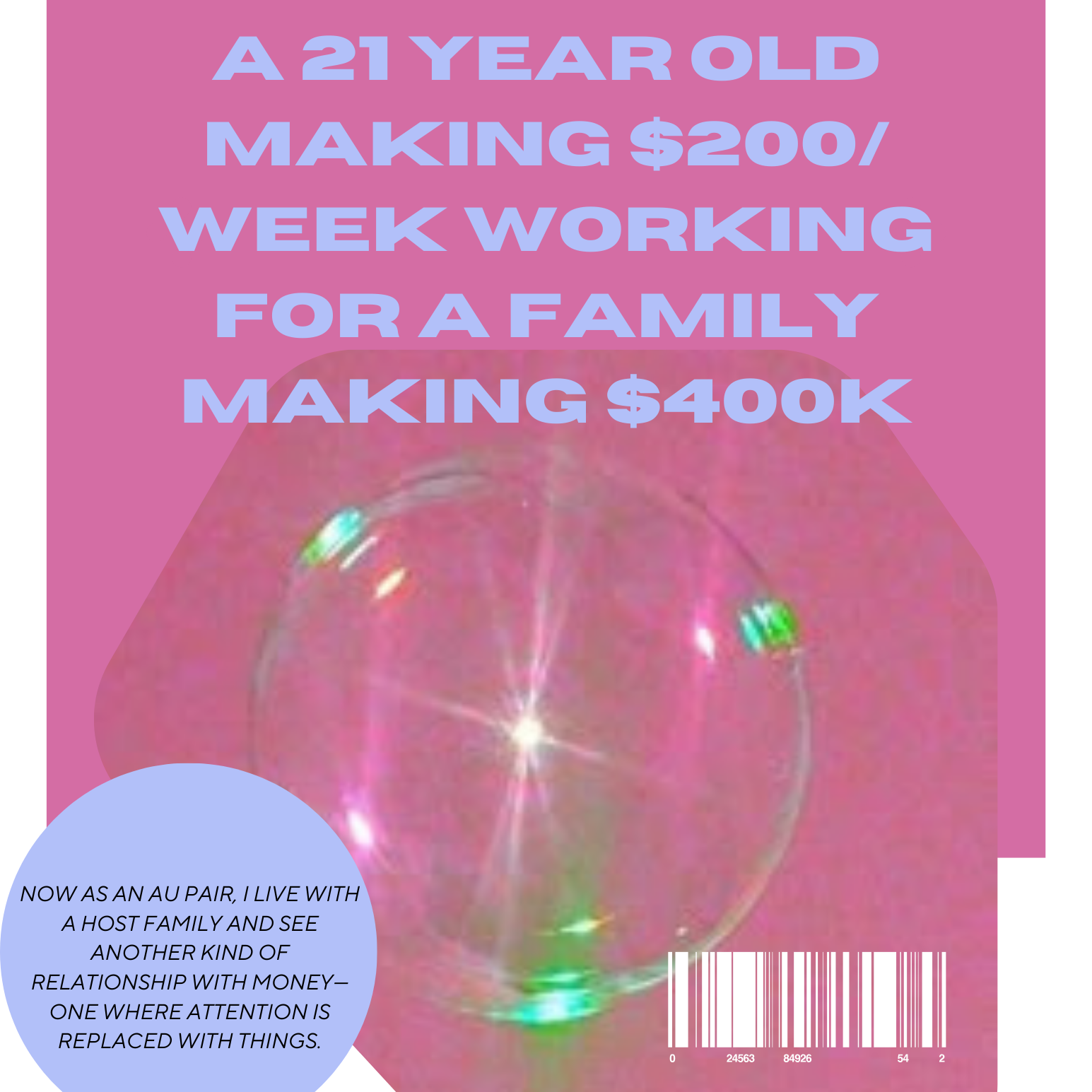

Today: A 21-year-old European au pair in New York earning $200/week while working full-time for a family she estimates makes $400,000/year, based on Glassdoor salary data for their jobs. With a net worth of €1,000, she reflects on how money shapes family dynamics, parenting, and personal boundaries.

Age: 21

Net Worth (Assets & Debt): €1,000 savings, no debt

Salary (or Primary Income Source): $200/week as an au pair

Region: New York

Industry: Childcare

Now as an au pair, I live with a host family and see another kind of relationship with money—one where attention is replaced with things. The kids talk about their grandmas like, “This one’s better because she gives me more gifts.” It’s not even subtle.

What did your early experiences teach you about money?

I started working when I was 16, babysitting for a family that was really struggling. They were on government assistance, and I remember being surprised by the choices the mom made. Sometimes there wouldn’t be much food in the house, but there were always three bottles of wine. It made me think that maybe not everyone sees money the same way—like maybe some people just don’t prioritize it.

Now as an au pair, I live with a host family and see another kind of relationship with money—one where attention is replaced with things. The kids talk about their grandmas like, “This one’s better because she gives me more gifts.” It’s not even subtle. And the parents do the same—buying toys instead of spending time with them. The boys don’t really understand the value of money. They throw food away like it’s nothing because, “We can buy more.”’

That’s really different from how I grew up. My family—especially the women—really emphasized saving, planning, and thinking about what you need versus what you want. If I already had a jacket and wanted a new one just because I liked it, my mom would say, “That’s fine, but you’ll have to use your own money.”

My cousins and I would get allowances, and our parents would ask us how we wanted to use it. Like, “Do you want something now, or do you want to save and get a bigger gift for Christmas?” We had to think about those things at a young age. It taught me a lot about planning and patience.

Do you support anyone financially?

Right now, all the money I earn is mine. Sometimes my family in Spain sends me a little money, just to help or show love, but I’ve never asked for it. And when they do, I try to give back in small ways—sending them gifts or treats for birthdays and holidays. It’s a nice way to stay connected.

I grew up thinking it was normal to be raised by your parents—even if they worked full time, they were still around. Here, I see kids spending most of their time with nannies or au pairs while their parents buy them things to make up for it. It just feels kind of off to me.

Was there a defining moment that changed how you see money?

Living with my host family and seeing how they parent with money instead of time really shocked me. I grew up thinking it was normal to be raised by your parents—even if they worked full time, they were still around. Here, I see kids spending most of their time with nannies or au pairs while their parents buy them things to make up for it. It just feels kind of off to me.

It made me realize how important it is not to use money as a replacement for love or presence. That’s not the kind of parent I want to be.

Do you want kids some day?

Maybe—if I do, it’ll be later in life, like my mid-30s. But only if I’m financially stable. I don’t mean rich, but I want to know I can provide for a child even if something goes wrong. I want enough savings to get by for a year or two without help if I lose my job or need to move.

And I’d want to raise them in a family setting, not leave them with strangers all the time. You just never know how that’ll affect them.

How did you feel when you learned your host family’s salary?

When I first saw how much they made, I was just shocked. It was so much money. But I didn’t feel like I deserved more just because of that. I figured they probably studied hard and worked a long time to get there. They have their own priorities, and I respect that, even if I wouldn’t make the same choices.

What’s your definition of financial stability?

For me, it’s not about having millions—it’s about knowing I can handle a crisis. Like if I lose my job, I want to know I can still pay for rent and food and take care of my child, if I have one.

Love is more important than buying everything, but financial security is essential. I want that solid base.

When I came to the U.S. as an au pair, I had to pay $1,800 to the agency, which covered my insurance, flights, and some of the documents. My parents helped with half since I didn’t have the full amount saved. But once I arrived, my mom made it clear—no more money from her for at least a year.

What’s the most significant financial decision you’ve made?

I started paying for my own things pretty early, and when it came to my degree—which cost about €3,000 a year—I paid for it myself. I got some scholarships from Madrid that helped a lot. One year, it covered almost everything.

My parents actually offered to cover my tuition and let me keep the scholarship money, but I decided to use it for school. I saw it as my responsibility, and it felt good to do that.

When I came to the U.S. as an au pair, I had to pay $1,800 to the agency, which covered my insurance, flights, and some of the documents. My parents helped with half since I didn’t have the full amount saved. But once I arrived, my mom made it clear—no more money from her for at least a year. And I agreed with her. She had already helped so much, and now I earn my own money.

Has social media influenced your spending?

Yes, 100%. Social media totally makes me want things I didn’t even know I wanted. I’ll see someone with a certain pair of boots and suddenly think I need them too. Trends just get in your head—you see something enough, and you start liking it.

Cheap apps like Shein and Temu make it worse. It’s so easy to spend money on things you don’t need. You end up with a ton of clothes and only wear half.

Do you use social media to learn about money?

Not really. I feel like I already learned most of what I need to know from my family.

I’ve talked about investing, but haven’t actually started. My mom used to invest—she made a bit of money back years later. I had a friend who had this savings setup where his bank would round up his purchases and save the extra. It sounded really smart.

I tried using an app like that, but it required a U.S. number. I technically had one, but it was shared with my host family and the app thought I was someone else. So I couldn’t even log in.

So where is your savings now?

It’s just in a bank account. I know inflation makes it lose value over time, but honestly? I don’t know much about that stuff, so I’m not really worried yet.

Leave a Reply